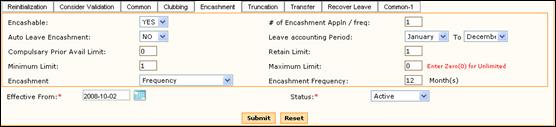

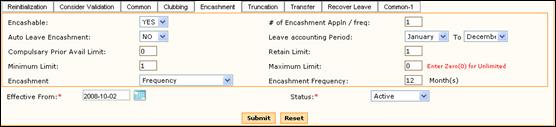

What is Leave Encashment?

Encashment is availing cash benefit in lieu of unavailed leave. For example, an employee is eligible for 15 days of leave in a year, out of which 10 days is availed and remaining 5 days leave is unavailed. In this case, the employee can opt for encashing the 5 days leave in accordance with the policies of the organization.

How to use this tab?

Field |

Description |

Encashable |

Select ‘Yes’ or ‘No’. This is to specify whether the leave is encashable. If this option is selected as ‘No’ then the employee cannot encash this type of leave. |

# of Encashment Appln /Frequency |

This is to specify the maximum number applications for encashment that can be raised for a frequency. |

Auto Leave Encashment |

This is to set Leave encashment to populate automatically. If this option is selected as ‘Yes’ then all other fields in this tab will be disabled. |

Leave Accounting Period |

This is to specify the leave period that is to be taken into account. Select the period. |

Compulsory Prior Avail Limit |

This is to specify the number of days to be availed compulsorily in the current leave accounting year prior to encashment. |

Retain Limit |

This specifies that the employee has to maintain certain amount of leave balance while encashing. Only the balance leave excluding the retain limit days can be encashed. |

Minimum/Maximum Limit |

This is to specify the minimum and maximum number of days an employee can encash for a particular leave type. |

Encashment |

This is to specify the type of encashment. If Separation is selected, then it cannot be encashed using the encashment form. Encashment will be done only at the time of separation of an employee. If Encashment is selected then it can be encashed using the Leave Encashment form. |

Encashment frequency in month(s) |

This is to specify the month in which the encashment has to be done. Enter the number of months. Note: The encashment frequency should not exceed 12 months. |