Component Master

Why should I use this form?

Use this form to create various components that will be used in claims.

The earnings, deductions, pay elements like BASIC, HRA, PF are terms as components in payroll. The component can be defined as Fixed, Variable, Formula

· FIXED - the amount is constant for all months, till next change like Basic.

· VARIABLE - the amount is paid for a specific month like bonus, incentive, etc..

· FORMULA – simple or complex formulas can be defined to compute the amount.

· Simple formula - HRA = BASIC*50/100

· Complex formula - CONVEYANCE = IF Grade = ‘G1’ then 800, if Grade = ‘G2’ then 1000

Note: Claim components should be created as ‘Formula’ components.

What are the Pre-requisites?

· Pay Group should be available

· Calculation Type should be defined

Who can access this form?

This form shall be visible to all employees to whom the visibility is given in Product Setup à Module Role Mapping/Module Administration.

How to navigate to this form?

Point to Payroll menu, select Component under Master.

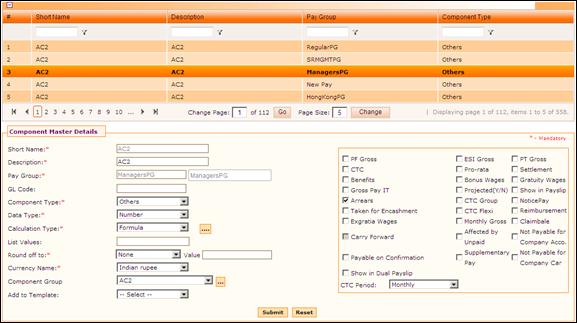

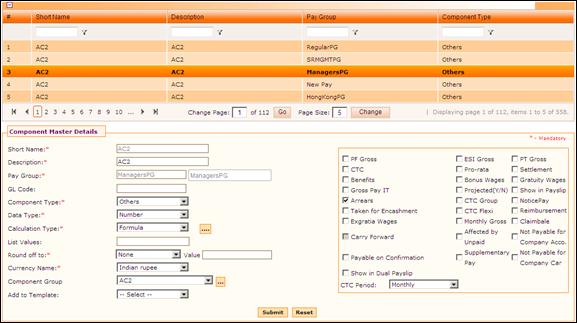

The grid in this form shows the list of existing Components. Use the filter section to filter records in the grid based on a condition.

Click the [+] icon on the left top of the grid to show / hide the grid.

The field guidelines are as follows.

Field Name |

Description |

Short name |

Enter the short name of the component. This accepts only alphabets and numbers. The short name can start with alphabets only. |

Description |

Enter the description of the Component. |

Pay Group |

Enter ‘@@’ in the Pay Group field, which populates list of available Pay Groups in a drop down, as shown here:

You can also enter Pay Group Name to filter the search. For example, in the screenshot given below, the Pay Group name has been entered, and hence the drop down is showing records based on the entered Pay Group name

Select required Pay Group. |

Component Type |

Select the component type from the dropdown list; · Earnings – The defined parameters will fall under Earning component · Deductions - The defined parameters will fall under Deduction component · Others - The defined parameters will fall under Others component |

Data Type |

Select the Data type from the dropdown list. This will determine how the input has to be provided for the particular component · Boolean - using a system of symbolic logic that uses combinations of logical operators such as "AND," "OR," and "NOT" Boolean operators to determine relationships between entities. · Character – The Data type will be in the form of special characters like, @, #, $ · Date – The Data type will be in the form of date format. · Number – The Data type will be represented in numbers · List – These values will be hardcoded. |

Calculation Type |

Select the type of calculation · Fixed – When Fixed is chosen, the component is considered to be fixed without any variations or calculation. · Formula – if Formula is chosen, a pop up screen is displayed as shown below: To define a component for Loan, then the Calculation Type should be selected as ‘Formula’. If the Calculation Type is chosen as ‘Formula’, then click the ellipse button to view/edit the formula. The formula builder window appears, as shown here:

Click [Check Exp] to check if the defined formula is correct Click [Ok] to save the defined formula Note: [Ok] button will be enabled only if the formula is correct Variable - When Variable is chosen, the component values varies every month or every wage period. |

List Values |

Enter the values to be shown. Note: This field will be enabled only if the Data Type is selected as ‘List’. |

Round off to |

Select the type to round-off · None – The value will not be rounded-off. Any desired value can be given in the field called ‘Value’. · Nearest – the value will be rounded-off to the next nearest value. · Higher - the value will be rounded-off to the next highest value. eg; 50.6 will be considered as 51 · Lower - the value will be rounded-off to the nearest lower value. eg; 50.6 will be considered as 50 only. Enter the value and enable the checkbox to carry forward the entered value Note: These values will be hard-coded. |

Reimbursement |

Click this checkbox if this component has to be considered for Reimbursement. If unchecked, then this component will not be considered for Reimbursement. |

Currency Name |

Select the currency name from the dropdown list. Note: Currencies that are mapped in the Currency Master will be listed in this field. |

Component Group |

Select the component group to which the component belongs. |

Component Settings section

This section facilitates mapping various attributes for a component.

· PF Gross - The components marked for PFGROSS will be considered for PF calculation

· ESI Gross - The components marked for ESIGROSS will be considered for ESI calculation

· PT Gross - The components marked for PTGROSS will be considered for PT calculation.

· Monthly Gross - The components marked for MONTHLY GROSS will be part of Gross earning and Gross deduction in pay slip. All the earnings components marked for Monthly gross will be part of gross earnings. All the deduction components marked for Monthly gross will be part of gross deductions.

· Payable on Confirmation – Components that will be paid only upon confirmation of the employee.

· Gross Pay IT - The components marked for GROSS PAY IT, will be considered for income tax calculation.

· Projected (Y/N) - This will define if the parameter is to be considered as Projected or the actual value for income tax calculation.

· Show in Pay slip - Selecting this will display the component details in the Payslip

· Pro-rata - This will be useful when there is a need to Pro-rate the value. eg: When an employee joins in the middle of a month, the salary has to be calculated only for the days the employee has worked.

· Arrears - This refers to the unpaid, unsettled or salary kept on hold, which has to be paid to the employee as Arrears.

· Affected by Unpaid - This refers to all the parameters which will not be affected during Loss of Pay.

· Taken for Encashment - This refers to the parameters which will be considered during encashment. eg; Leave encashment

· Settlement - This denotes that the parameter will be considered during settlement process

· Bonus wages - This refers to the parameters that are considered for bonus calculation, in addition to the salary.

· Ex-gratia wages - This will consider the parameters for calculating Ex-gratia wages

· Gratuity wages - This will consider the parameters for calculating Gratuity

· Notice pay - This refers to the parameters that will have to be taken for Notice Pay

· CTC - This refers to the CTC for an employee as defined by the company.

· CTC Flexi - This refers to the CTC for an employee, in which the employee can distribute the components as permitted.

· Reimbursement - This will consider the parameter for calculating Reimbursement

· CTC group – This is to link a component that has multiple sub-components to a CTC group. For example, if there is a component called PDP which consists of two sub-components: (i) Individual Performance pay which is 60% of PDP; and (ii) Team Performance which is 40% of PDP. In such a case, PDP will be defined as a component in CTC group and the sub-components (Individual Performance and Team Performance) are linked to PDP.

· Show in Dual Payslip - This will consider where two CTC’s are applicable. The components mapped to the second CTC will be included in the second payslip

Click [Submit] to save the details.

Click [Reset] to refresh the form.

Click on the Active check box if the component master form is valid. Uncheck the box if the component master form is invalid or not in use.

To modify any existing Pay Group, select the record from the grid. Selected record will be populated in the form. Make necessary changes and click [Submit] to save the changes.